In real estate, understanding what constitutes an unfair decision is crucial for procedural fairness. Individuals can empower themselves using digital resources to navigate legal frameworks, scrutinize factual accuracy, and verify compliance with laws, potentially reducing appeals. As a property owner, appealing an unfair decision involves gathering documents, reviewing rules, preparing a statement, filing within time limits (often through official portals), and tracking communications. Tenants and homeowners can challenge decisions based on procedural errors, inadequate notifications, inaccurate info, or biased decision-making, ensuring justice and fairness in transactions like tax assessments, foreclosure, and discrimination cases.

Unfair real estate decisions can be a contentious issue for property owners. If you’ve been affected by a decision that seems unjust, know that there’s often an appeal process available. This comprehensive guide delves into understanding unfair real estate transactions, walking you through the appeals process step-by-step, and highlighting common reasons why decisions may be deemed unfair—along with exploring potential appeal opportunities.

Understanding Unfair Decisions in Real Estate Transactions

In the realm of real estate, decisions can range from celebratory to contentious. What constitutes an unfair decision in a transaction is nuanced and varies across jurisdictions. Whether it’s a dispute over property boundaries, pricing discrepancies, or alleged breach of contract, understanding what makes a decision unfair is paramount. The key lies in evaluating if the outcome deviates significantly from what a reasonable party would expect under similar circumstances.

Real estate transactions are intricate labyrinths involving multiple stakeholders and legal frameworks. To determine if an appeal is warranted, it’s crucial to scrutinize procedural fairness, factual accuracy, and adherence to applicable laws. In today’s digital era, where information is readily accessible, folks can better navigate these complexities. By staying informed about their rights and the intricacies of real estate practices, they can ensure that decisions are fair and just, thereby minimizing the need for appeals.

The Appeals Process: Step-by-Step Guide for Property Owners

If you’re a property owner and feel that a recent decision regarding your real estate has been unfair, knowing how to appeal it is crucial. The appeals process can vary depending on your location, but here’s a simplified step-by-step guide to help you navigate it effectively.

First, gather all the necessary documents related to your case, including any previous correspondence with the relevant authorities or agencies. Secondly, review the specific rules and regulations regarding real estate appeals in your area. This will help you understand what grounds for appeal are acceptable. Next, prepare a detailed statement outlining your reasons for believing the decision is unfair, citing relevant laws, policies, or past cases to support your argument. Once ready, file your appeal within the specified timeframe, usually through the official government portal or with the appropriate local authority. After filing, stay proactive by setting reminders for follow-up actions and keeping track of any communications related to your appeal.

Common Reasons for Deeming a Decision Unfair and Appeal Opportunities

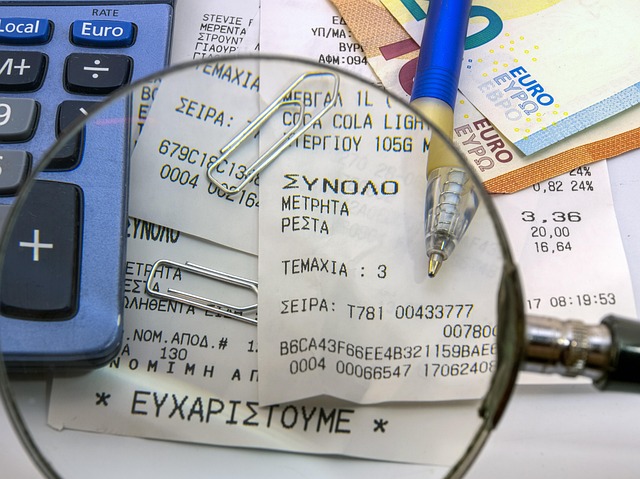

In the realm of real estate, decisions regarding property disputes, evictions, or financial assessments are subject to scrutiny and appeal if deemed unfair. Common reasons for such determinations include procedural errors, lack of proper notification, inaccurate information, or bias in the decision-making process. For instance, a tenant might challenge an eviction order if they were not served properly or had extenuating circumstances that weren’t considered.

When a decision is believed to be unfair, individuals have recourse through appeal procedures. These opportunities allow parties involved to present new evidence, clarify misunderstandings, and argue against the initial ruling. Whether it’s appealing a property tax assessment, contesting a foreclosure, or seeking redress for discriminatory practices in real estate transactions, understanding the grounds for unfairness and the available appeal processes is crucial for ensuring justice and fairness in the industry.