Understanding real estate ownership costs beyond the initial purchase price is vital for both investors and homeowners. These costs encompass property taxes, insurance, maintenance, repairs, and emergency funds, varying by location, property value, coverage types, and other factors. By factoring in these diverse expenses, individuals can make more informed decisions in the real estate market, ensuring financial stability throughout ownership.

In the dynamic realm of real estate, understanding overall ownership cost is pivotal for savvy investors. This article delves into the multifaceted components that significantly impact these expenses, providing a comprehensive guide for both novice and seasoned property owners. From deciphering ownership costs’ various elements to exploring strategic cost-saving measures, we navigate the landscape of long-term vs short-term expenditures. By harnessing insights on initial purchase prices, maintenance, taxes, utilities, and more, readers can make informed decisions, ensuring optimal financial health in the real estate market.

Understanding Ownership Costs in Real Estate

In the world of real estate, understanding ownership costs is paramount for both investors and potential homeowners. These costs extend beyond the initial purchase price and encompass a variety of expenses that significantly impact overall financial burden. From property taxes and insurance to maintenance and repairs, each aspect contributes to the overall cost of owning a piece of real estate. By comprehending these various expenditures, individuals can make more informed decisions when navigating the real estate market.

Delve into the specifics of each expense to gain a comprehensive view. For instance, property taxes vary based on location and the value of the property, while insurance premiums are influenced by factors such as the type of coverage, the property’s condition, and its vulnerability to natural disasters. Regular maintenance, including cleaning, minor repairs, and upgrades, is essential to preserving the property’s value and minimizing unexpected costs. Moreover, budgeting for potential emergency repairs or unforeseen circumstances ensures financial stability throughout ownership.

– Define ownership costs and their components

Ownership costs in real estate encompass a multifaceted array of expenses that significantly impact the overall financial burden of property ownership. These costs can be broken down into several key components, each contributing to the overall expense of maintaining and operating a property. One such component is the direct cost associated with mortgage or rent payments, which represents a substantial portion of an owner’s or tenant’s monthly expenditure. Additionally, there are indirect costs like property taxes, insurance premiums, and utility bills that further enhance the financial obligations tied to real estate ownership.

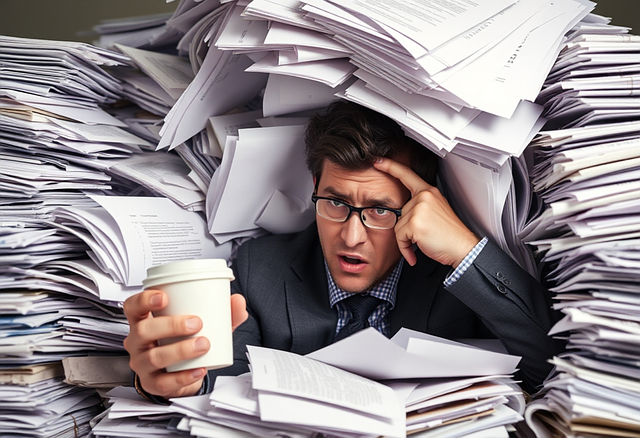

Furthermore, maintenance and repair expenses, often overlooked but crucial, add to the ownership cost equation. These expenditures can vary widely depending on the age, size, and condition of the property, as well as market factors such as local labor rates and material costs. Regular upkeep is essential not only for preserving property value but also for mitigating unexpected, costly repairs that could arise from neglect or unforeseen circumstances.

– Importance of considering long-term vs short-term expenses

When considering the impacts on overall ownership cost in real estate, it’s crucial to look beyond immediate, short-term expenses. Investors often focus on the quick returns and monthly cash flow, but sustainable success requires a long-term perspective. By prioritizing short-term gains, they might overlook essential maintenance costs, property depreciation, and potential market fluctuations that can significantly erode profits over time.

A smart approach in real estate involves balancing current income with future expenses and potential appreciation. Understanding the lifecycle of a property investment is vital; understanding that significant repairs or upgrades may be necessary over the years ensures investors are prepared and can plan accordingly. This long-term vision allows for more accurate budgeting, higher profitability, and reduced financial surprises down the line.